|

Introduction

Operated by Key Way Investments Limited, CAPEX.com is an online trading company specialized in offering services not just related to cryptocurrencies, with bonds commodities, forex, indices, shares, and ETF also covered. Licensed by CySEC, and registered with FCA (UK), BaFIN (DE), and KNF (PL), the company stands head-and-shoulders above most of the other players who offer cryptocurrency trading services.

The main disadvantage, though, is that just a few cryptocurrency-related pairs are being covered. BCHUSD, BTCFUTURES, DASH, Ethereum, Litecoin, and Ripple are the only ones available at the time of writing. There are no commissions involved, but spreads can be high on BCHUSD and DASH.

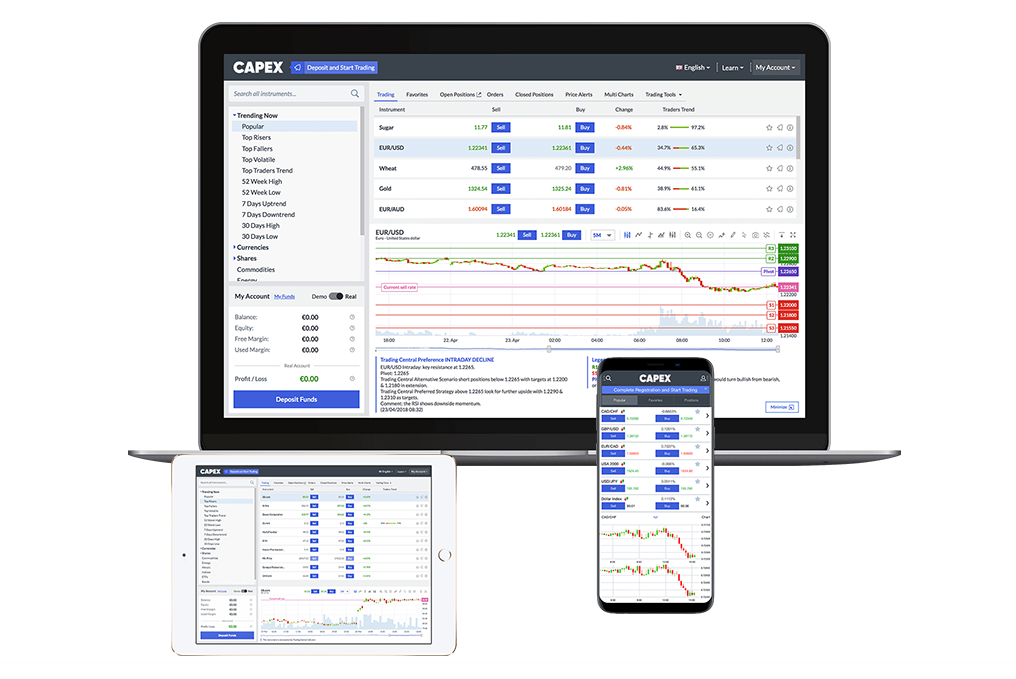

Trading Platforms

Capex relies on two main platforms; one is its proprietary web-based software and the other is the popular MT5. The company claims to have developed a powerful, easy-to-use and intuitive web-based trading platform. WebTrader is providing a wide range of instruments, essential charting tools, trader trends, economic calendar, and access to the popular technical analysis tool Trading Central. The Capex web-platform can be accessed via any popular browser and the company also developed apps for Android and iOS devices.

MT5 does not fall too much behind, with cutting-edge performance, multiple enhanced features, and a large variety of charts and analytics. With Capex, clients will get access to highly customizable accounts, a variety of price chart types and timeframes, up to 10 charts simultaneously, feature-rich trading systems and many others. The MT5 platform is available on PC, laptop, tablet or any mobile device with Android or iOS.

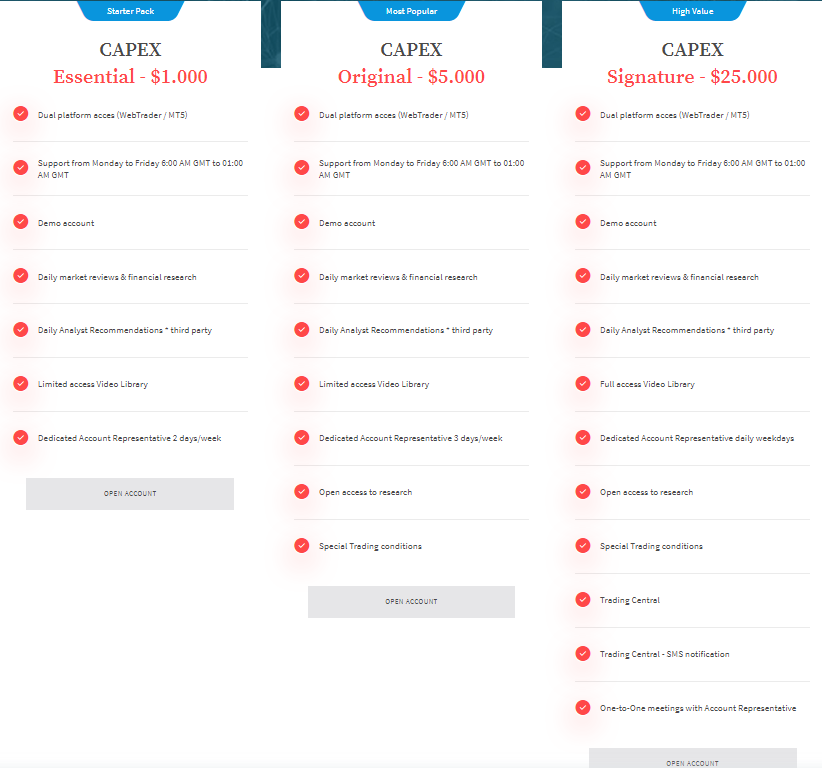

Account Types

At the present time, there are three different types of accounts available at Capex. Potential clients can choose between Essential, Original, and Signature accounts. Features are relatively the same for all, with a few exceptions. Original account holders will get open access to research, and special trading conditions, while signature accounts will be able to use the Trading Central, get Trading Central SMS notifications, and one-to-one meetings with account representatives.

In order to open an essential account, the minimum deposit required is currently $1,000, which may be unaffordable for some traders who want to start with less capital. Still, you should consider that you won’t be able to trade for a living by depositing a few bucks.

Promotions

As a brokerage company operating mainly in Europe, Capex must comply with the latest regulation, which means it cannot offer any trading promotions for retail clients. There won’t any bonus on deposits or other incentives.

Education

The Capex academy offers access to a wide range of video lessons. If you want a Forex Beginners Course, material on CFDs and Shares, forex videos, forex terms lessons, and some advanced content, you’ll find everything in one place. At the present time, there is no material on cryptocurrency trading, but if your goal is to use technical analysis, the information will be very useful.

You can use the same technical principles applied for forex, shares, commodities, etc. in cryptocurrencies, especially considering that Capex currently offers coverage for liquid digital currencies. Other useful resources are available via Trading Central, but unfortunately, it’s available only for Signature account holders.

|

CAPEX Review

Product Name: CAPEX

Product Description: Operated by Key Way Investments Limited, CAPEX.com is an online trading company specialized in offering services not just related to cryptocurrencies, with bonds commodities, forex, indices, shares, and ETF also covered. Licensed by CySEC, and registered with FCA (UK), BaFIN (DE), and KNF (PL), the company stands head-and-shoulders above most of the other players who offer cryptocurrency trading services.

Brand: CAPEX

Offer price: 0.0

Currency: USD / EUR / GBP

Offer URL: https://www.capex.com/en

-

Trading Platform

-

Languages

-

Spread

-

Support

Summary

The main disadvantage, though, is that just a few cryptocurrency-related pairs are being covered. BCHUSD, BTCFUTURES, DASH, Ethereum, Litecoin, and Ripple are the only ones available at the time of writing. There are no commissions involved, but spreads can be high on BCHUSD and DASH.